Planning your financial future requires understanding how your credit score might change over time. Credit monitoring has become essential for millions of Americans who want to make informed decisions about their financial health. Communal Business recognizes this growing need and provides comprehensive resources to help consumers navigate the complex world of credit management.

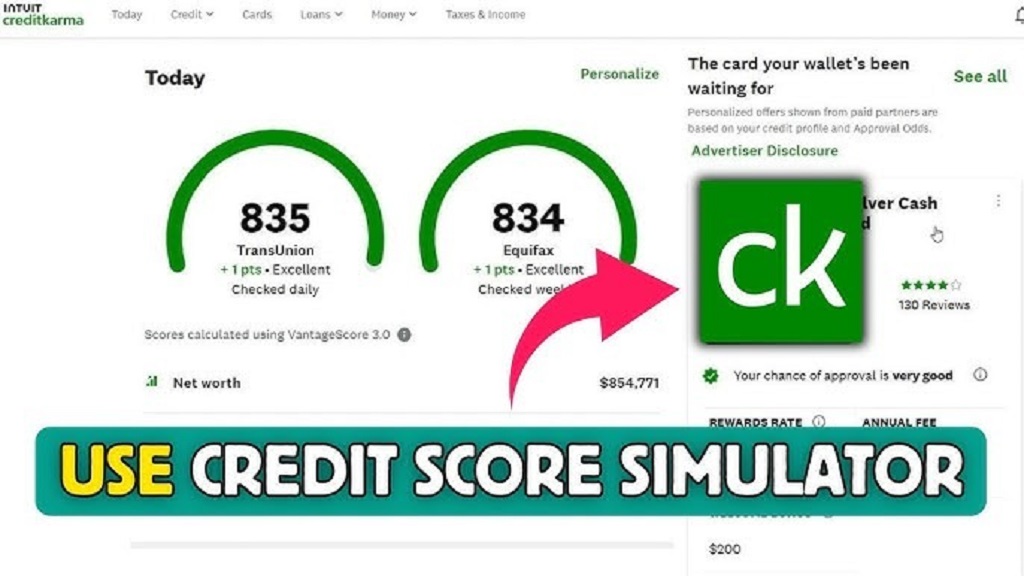

Understanding your credit trajectory doesn’t have to be a guessing game anymore. Today’s technology allows you to explore various scenarios and see how different financial decisions might impact your score. The credit karma score simulator offers a powerful way to model these changes before making major financial moves.

However, many people don’t fully understand how these prediction tools work or how to use them effectively. This comprehensive guide will walk you through everything you need to know about credit score simulation and help you make better financial decisions.

What Is a Credit Score Simulator?

Credit score simulators are digital tools that help predict how specific financial actions might affect your credit score. These tools use mathematical models based on credit scoring algorithms to estimate potential changes to your creditworthiness.

Most simulators allow you to input various scenarios, such as paying off debt, opening new accounts, or missing payments. The tool then calculates how these actions might influence your score over different time periods. Additionally, some advanced simulators can show you multiple scenarios simultaneously, helping you compare different strategies.

The accuracy of these predictions depends on several factors. Therefore, it’s important to understand that simulators provide estimates rather than guaranteed outcomes. Your actual credit score changes may vary based on timing, other financial activities, and updates to credit scoring models.

How Credit Karma’s Score Simulation Works

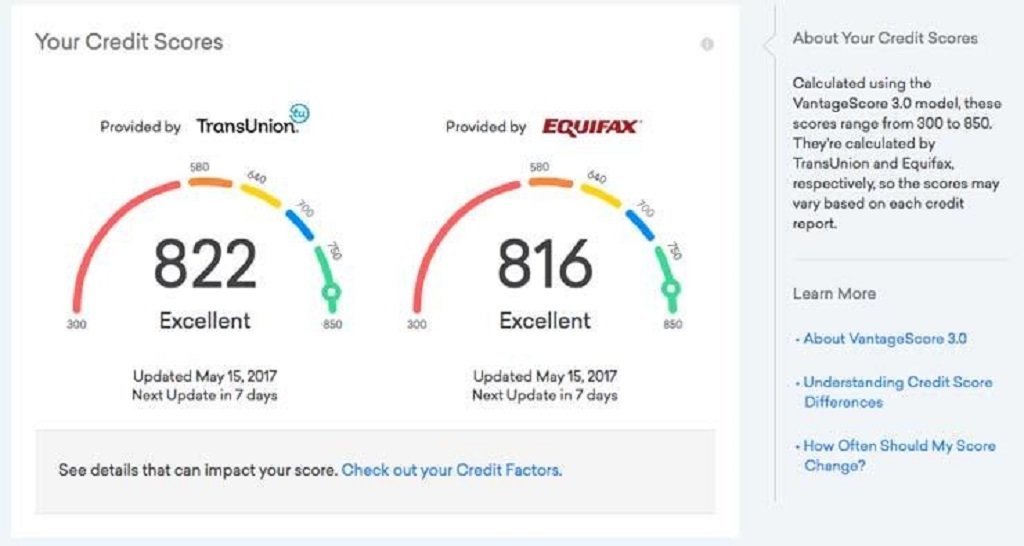

Credit Karma uses VantageScore models to provide credit score simulations for its users. The platform analyzes your current credit profile and applies known scoring factors to predict potential changes. Furthermore, the system considers your payment history, credit utilization, account age, and credit mix when making calculations.

The simulation process begins by examining your existing credit report data. Subsequently, the tool applies various scenarios to this baseline information. The system then calculates how each scenario might shift your score based on established credit scoring principles.

Users can typically explore scenarios like paying down credit card balances, closing accounts, or applying for new credit. However, the tool’s effectiveness depends on having accurate and up-to-date credit information in your profile.

Key Features of Credit Score Simulators

Modern credit simulators offer several valuable features that help users make informed decisions. Most tools provide scenario modeling for common financial actions such as debt payoff strategies and new account applications. Additionally, many simulators show projected timelines for score improvements.

Interactive elements allow users to adjust variables and see real-time predictions. Therefore, you can experiment with different approaches to find the most effective strategy for your situation. Some advanced features include goal-setting tools and personalized recommendations based on your credit profile.

The best simulators also provide educational content explaining why certain actions affect your score. This knowledge helps users understand the underlying principles of credit scoring rather than simply following suggestions blindly.

Benefits of Using Credit Score Prediction Tools

Credit score simulators offer numerous advantages for financial planning and decision-making. These tools help you avoid costly mistakes that could damage your credit score for months or years. Furthermore, simulators enable you to prioritize debt payoff strategies for maximum score improvement.

Planning major purchases becomes easier when you can predict how your actions might affect your creditworthiness. Additionally, simulators help you understand the potential timeline for reaching specific credit score goals. This information proves valuable when applying for mortgages, auto loans, or other major credit products.

However, simulators also help build financial literacy by demonstrating cause-and-effect relationships in credit scoring. Users develop a better understanding of how their financial behaviors impact their overall credit health.

Common Scenarios to Test with Simulators

Several common financial scenarios benefit from simulation before implementation. Debt consolidation represents one popular use case, as users can compare different approaches to combining multiple debts. Additionally, credit card balance transfers often require careful analysis to ensure they provide genuine benefits.

Mortgage preparation frequently involves credit score optimization strategies. Therefore, many users simulate the effects of paying down specific debts or avoiding new credit applications before applying for home loans. Auto loan preparation follows similar principles but often requires shorter-term planning.

Business credit applications present another scenario where simulation proves valuable. Furthermore, users often test the impact of closing unused credit accounts or requesting credit limit increases on existing cards.

Limitations and Considerations

While credit simulators provide valuable insights, they have important limitations that users should understand. Simulators cannot account for all variables that influence credit scores, such as data reporting delays or scoring model updates. Additionally, the predictions assume that you won’t make any other credit-related decisions during the projected timeframe.

Different credit scoring models may produce varying results for the same scenario. Therefore, simulator predictions might not match the exact scores used by specific lenders. Credit reports can also contain errors that affect simulation accuracy, making regular credit monitoring essential.

Market conditions and lending practices can influence how lenders view credit scores over time. Furthermore, life events such as job changes or medical expenses might disrupt planned financial strategies, affecting predicted outcomes.

Maximizing Simulator Effectiveness

To get the most accurate predictions from credit simulators, start by ensuring your credit reports contain current and correct information. Review all three credit reports for errors and dispute any inaccuracies before running simulations. Additionally, update your Credit Karma profile regularly to reflect recent account changes or payments.

Test multiple scenarios to compare different approaches to your financial goals. However, focus on realistic scenarios that you can actually implement rather than extreme or unlikely situations. Consider both short-term and long-term impacts when evaluating different strategies.

Document your simulation results and create an action plan based on the most promising scenarios. Therefore, you can track your progress and adjust your strategy as needed. Remember that consistency in following through on planned actions is crucial for achieving predicted results.

Best Practices for Credit Score Improvement

Successful credit score improvement requires combining simulation insights with proven credit management strategies. Pay all bills on time consistently, as payment history represents the most significant factor in most scoring models. Additionally, maintain low credit utilization ratios across all credit cards and credit lines.

Avoid closing old credit accounts unless they carry annual fees that outweigh their benefits. Furthermore, limit applications for new credit to necessary purchases or strategic moves that simulators suggest will improve your score. Diversifying your credit mix can help, but only pursue this strategy if you can manage the additional accounts responsibly.

Monitor your credit regularly to track progress and identify any issues quickly. However, remember that credit score changes often take time to appear, so patience and consistency are essential for long-term success.

Alternative Credit Monitoring Tools

While Credit Karma provides popular simulation features, several other platforms offer similar capabilities. Many banks now provide credit monitoring services with basic simulation features for their customers. Additionally, paid credit monitoring services often include more advanced prediction tools and additional credit report sources.

FICO offers its own set of simulation tools through various partner platforms. These tools use FICO scoring models, which many lenders prefer over VantageScore models. Therefore, users serious about credit optimization might benefit from using multiple simulation platforms to get broader perspectives on potential score changes.

However, free tools often provide sufficient functionality for most users’ needs. The key is choosing tools that align with your specific financial goals and the types of credit decisions you need to make.

Read More Also: Best Shirt Material for Sweaty Travelers

Conclusion

Credit karma score simulators represent powerful tools for financial planning and credit optimization. These platforms help users understand how various financial decisions might affect their creditworthiness over time. However, successful credit management requires combining simulation insights with consistent, responsible financial behaviors.

The most effective approach involves using simulators to test strategies before implementation, then monitoring actual results to refine your approach. Additionally, remember that credit improvement takes time and patience, regardless of what simulation tools predict.

By understanding both the capabilities and limitations of credit score simulators, you can make more informed financial decisions. Therefore, these tools serve as valuable additions to your overall financial planning toolkit, helping you work toward better credit health and improved financial opportunities.

Read More Also: Best Fabric for Heat Rash Prevention

Frequently Asked Questions

How accurate are Credit Karma score simulators?

Credit Karma simulators provide reasonable estimates based on VantageScore models, but actual results may vary. The accuracy depends on having current credit information and following through on simulated actions exactly as modeled.

Can I use simulators to improve my credit score quickly?

While simulators can identify the most effective improvement strategies, credit scores typically change gradually. Most positive changes take 30-60 days to appear, and significant improvements often require several months of consistent financial behavior.

Do credit simulators work for all types of credit scores?

Most simulators use either FICO or VantageScore models, but lenders may use different scoring versions. Simulator results provide general guidance, but specific lender requirements might vary from predicted outcomes.

How often should I use credit score simulators?

Use simulators when planning major financial decisions or every few months to reassess your credit strategy. Overusing simulators without taking action won’t improve your actual credit score, so focus on implementation rather than frequent simulation.

Are there any risks to using credit score simulators?

Credit simulators themselves don’t affect your credit score and are generally safe to use. However, acting on inaccurate information or misunderstanding simulator limitations could lead to poor financial decisions that impact your credit negatively.